Interest rates are near record levels.

This political environment is scary.

The U.S. debt level has skyrocketed.

The Social Security crisis is coming.

Déjà vu or déjà news? These concerns could have been from 30 years ago just as easily as last week. There is always a scary news headline out there … and, right or wrong, it’s the media’s job to catch your attention. That’s harmless enough if it makes you think and revisit your investment plan but can be downright dangerous if it always makes you play it safe and run for the mattress.

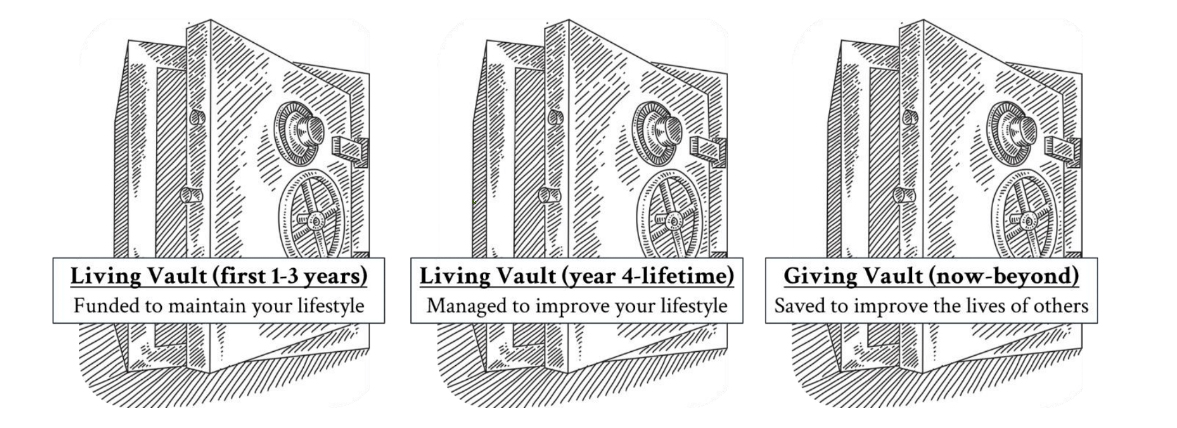

Our 3-Vaults Approach

The solution we use to help families battle investment anxiety and the mistakes it can bring on is our 3-Vaults approach. Every retirement plan we design includes a complete list of everything you own and everything you owe. Then a lot of thought and analysis goes into designing an investment plan that not only gets you to where you want to go but also in a way that’s appropriate for your risk appetite. Once your ideal investment portfolio is designed, we purposefully place different assets into different vaults. We break them down into those for LIVING and those for GIVING.

The first Living Vault is our beachhead against the war on bad investment behavior. Its purpose is to maintain your lifestyle and hold all your most conservative investments. It usually covers about three years of living expenses. It might include things like an emergency account, short-term bonds, social security, pension or annuity income, and even credit lines.

The second Living Vault is funded with the sole purpose of improving your lifestyle. Built for years 4 and beyond, it is designed to tackle longevity risk and defend against the silent eroding effects of inflation. It will hold your retirement accounts, growth portfolios, real estate, long-term care policies, and any excess pension, social security or annuity income. In many cases, this is the largest vault we build.

Finally, we have the Giving Vault which is managed distinctly to improve the lives of others. We know everyone has a different approach on giving and structure this to support a flexible giving strategy. Some want to plan for gifting every year, others for a special future occasion like college or a wedding, and many just want to pass a legacy on to family or charities. We would fund this vault with things like a long-term aggressive portfolio, low basis stock, life insurance, collectibles, a donor advised fund, 529 accounts, and a vacation home.

In practice, we would replenish the 1-3 year vault from the 4+ year vault when markets allow. If they don’t, we wait taking needed living expenses from that conservative 1-3 year vault, knowing that we have a beachhead there to weather any storm.

We have found that 1-3 year LIVING Vault gives the needed comfort to remain focused on the long-term investment plan. The calming effect of knowing exactly how next month’s expenses are going to be met is the secret weapon to improving results and investing through any environment and any market headline … no matter what the media tries to do to scare you.

Daniel T. Heth, CRPC, CIMA, CEPA is the founder and CEO of PRESERVE Wealth Management, a boutique registered investment advisory firm that specializes in getting families to and through retirement. Find out more about their unique process by clicking here.